How To Improve Your Credit Score in 2025 For Car Finance

Are you dreaming of driving away in your perfect car, but worried about your credit score?

You're not alone. In 2025, a strong credit score is more important than ever for securing favourable car finance terms. The good news? There are proven strategies to boost your score and make your dream car a reality.

Understanding Your Credit Score in 2025

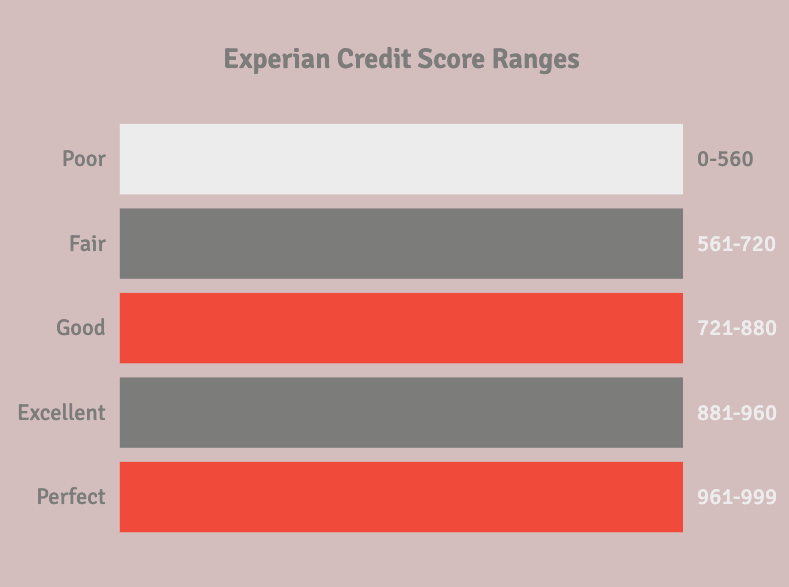

Your credit score varies between credit reference agencies in the UK, with Experian scoring from 0-999, Equifax from 0-1000, and TransUnion from 0-710. Most car finance providers consider an Experian score above 880 to be good, while scores above 960 can help you secure the best interest rates. But what exactly influences this crucial number?

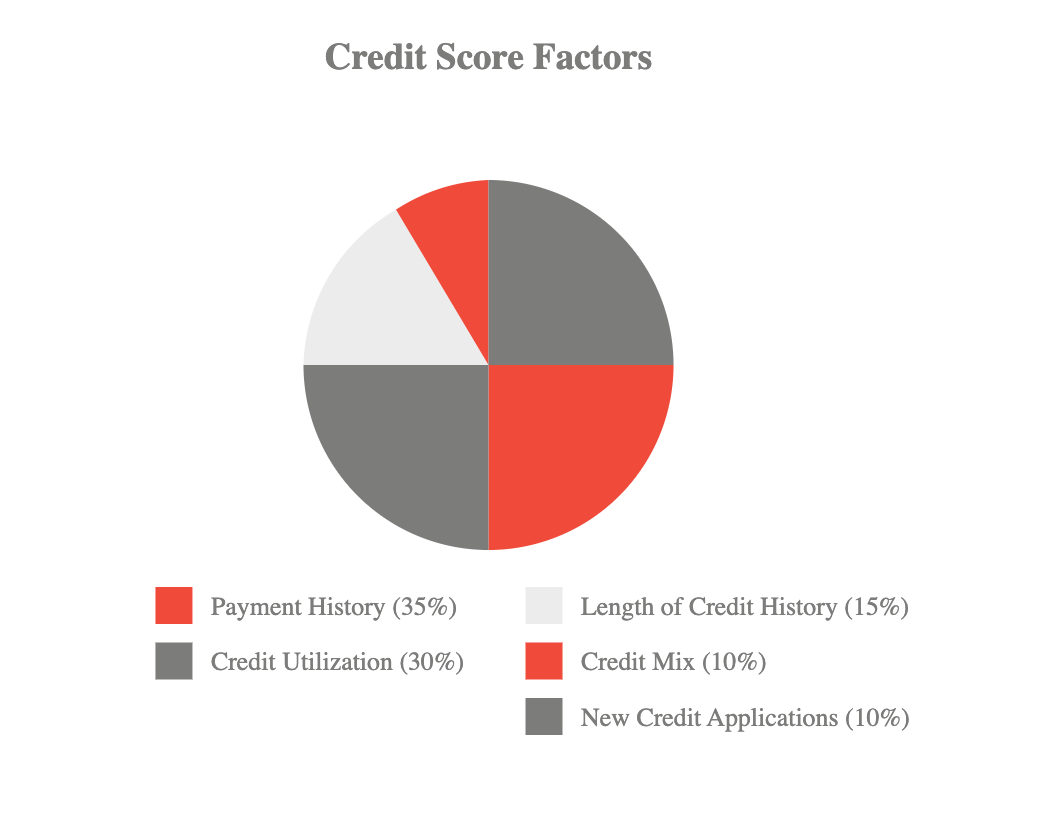

The main factors affecting your credit score include:

- Payment history (the most significant factor)

- Credit utilisation (how much of your available credit you're using)

- Length of credit history

- Credit mix (types of credit)

- Recent credit applications

Understanding these factors is crucial because it helps you focus your efforts where they'll have the most impact. For example, knowing that payment history carries the most weight, you can prioritise never missing a payment over other credit-building activities.

Quick Wins for Immediate Impact

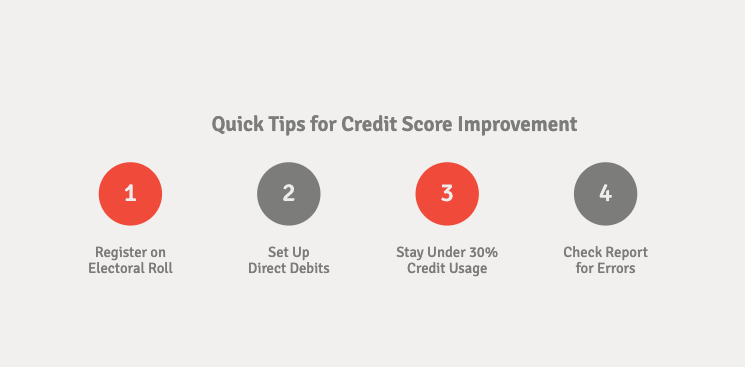

Start with these straightforward steps to see improvements in your credit score within months:

Register on the electoral roll at your current address. This simple action can add valuable points to your score by confirming your stability and identity to lenders. For Harrogate residents, this can be done easily through the North Yorkshire Council website.

Review your credit report for errors. Get your statutory credit report from each of the UK's three main credit reference agencies (Experian, Equifax, and TransUnion) and dispute any inaccuracies. Even small mistakes can significantly impact your score. Common errors include outdated addresses, incorrect account statuses, or fraudulent accounts in your name.

Set up direct debits for all regular payments. Late payments can severely damage your credit score, so automating your bills ensures you never miss a due date. Consider setting up payments for a few days after your regular payday to ensure sufficient funds are always available.

Medium-Term Strategies

These approaches require a few months to show results but can significantly boost your score:

Keep credit utilisation below 30%. If you have credit cards with £5,000 limits, aim to keep balances below £1,500. This shows lenders you can manage credit responsibly without relying too heavily on it. Top tip: Consider requesting credit limit increases on existing cards to lower your utilisation ratio without taking on new debt.

Maintain existing credit accounts. The length of your credit history matters, so keep old accounts open, even if you rarely use them. This demonstrates a stable credit relationship over time. Set up a small recurring payment on older cards (like a monthly Netflix subscription) and pay it off immediately to keep the account active.

Build a diverse credit mix. Having different types of credit (credit cards, personal loans, etc.) can improve your score, showing you can handle various financial commitments responsibly. However, only take on new credit types if they serve a genuine purpose in your financial life.

Long-Term Habits for Credit Success

Developing these habits will help maintain a strong credit score throughout 2025 and beyond:

Create a budget tracking system. Use banking apps or spreadsheets to monitor your spending and ensure you always have enough to cover credit payments. Many Harrogate residents find success with apps that categorise spending and send alerts when approaching budget limits.

Build an emergency fund. Having three to six months of expenses saved can prevent you from missing payments if unexpected costs arise. Consider opening a separate savings account specifically for emergencies. With the current economic climate, this buffer is more important than ever.

Space out credit applications. Each application typically results in a hard search on your credit file. Leave at least six months between applications to minimise impact. When car shopping, try to complete all finance applications within a 14-day window, as multiple car loan enquiries in this period typically count as one search.

Special Considerations for Car Finance

When specifically preparing for car finance:

Check for eligibility - Many lenders offer soft searches to check your likelihood of acceptance without affecting your credit score. At Carlingo, we can perform these checks across multiple lenders to find your best options.

Save for a larger deposit - A bigger down payment can improve your chances of approval and secure better interest rates, even with a less-than-perfect credit score. We recommend aiming for at least 10-20% of the vehicle's value as a deposit.

Consider a guarantor - If your credit score needs more time to improve, a guarantor with good credit could help you secure better terms. This person should understand their responsibilities and have a strong credit history.

Professional Support Available

At Carlingo, we understand that everyone's credit journey is different. Our finance team can provide personalised advice and help you understand your options, regardless of your current credit situation. We've helped hundreds of local customers improve their credit scores and secure affordable car finance.

Our team stays up-to-date with the latest changes in credit scoring models and lending criteria, ensuring you receive the most current and relevant advice. We can also connect you with local credit counselling services if you need additional support in building your credit score.

Take Action Today

Ready to improve your credit score and get behind the wheel of your dream car? Here's what to do next:

- Visit Carlingo at our showroom in Harrogate where our friendly team can discuss your car finance options. We're open Monday to Saturday, 08:30 AM to 6 PM, and Sundays 1!:00 - 17:00.

- Call us on 01423 803960 to schedule an appointment with one of our team who can create a personalised plan for improving your score. We'll take the time to understand your unique situation and develop strategies tailored to your needs.

- Use our online finance calculator and explore our current stock while you work on building your credit score.

- Don't let a less-than-perfect credit score hold you back from your dream car. Start implementing these strategies today, and you could be driving away in your perfect vehicle sooner than you think. Contact Carlingo in Harrogate now to begin your journey toward better credit and your ideal car.

*Note: Credit improvement takes time, and results may vary. This article is for informational purposes only and does not constitute financial advice. Please consult with financial professionals for advice specific to your situation.