The Hidden Costs of Car Ownership: What Your Monthly Budget Really Needs

When planning to buy a car, most people focus on the purchase price and maybe the monthly loan payments. However, the true cost of car ownership extends far beyond these initial figures. At Carlingo, we believe in transparent customer relationships. That's why we've created this comprehensive guide to help you understand and prepare for all the expenses that come with owning a vehicle.

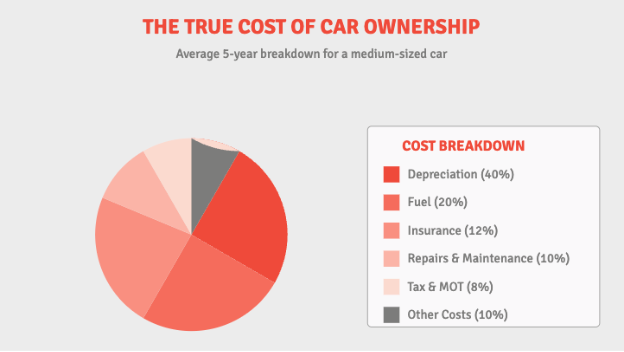

Beyond the Price Tag: Understanding Total Cost of Ownership

The purchase price of a car represents only about 40% of the total cost of ownership. The remaining 60% is made up of various ongoing expenses that many car buyers overlook when budgeting. Being aware of these costs can help you make more informed decisions about which vehicle is truly affordable for your lifestyle.

Depreciation

Depreciation is the largest expense of car ownership, yet it's one that most people never actively "pay" in a tangible sense. New cars typically lose 15-35% of their value within the first year and up to 50% within three years.

What this means for your budget: If you purchase a new car for £30,000, you might "spend" £10,500 in depreciation in just the first year, even if you don't realise it.

Carlingo tip: Used cars have already gone through their steepest depreciation period, making them a smarter financial choice. A quality 2-3-year-old car from Carlingo gives you excellent value while avoiding the most significant depreciation hit.

Fuel

Fuel costs can vary dramatically depending on your choice of vehicle, driving habits, and local fuel prices.

What this means for your budget: For a medium-sized car driven 12,000 miles per year in the UK, expect to spend between £1,500-£2,000 annually on fuel.

Carlingo tip: When browsing our stock, pay attention to the real-world MPG figures we provide. A difference of just 10 MPG can save you hundreds of pounds annually.

Insurance

Car insurance is a legal requirement and the cost varies based on factors like your driving history, the car's value, engine size and where you live.

What this means for your budget: Depending on your age, the average comprehensive car insurance policy in the UK costs around £460 annually, but premium vehicles or drivers with less experience might pay significantly more.

Road Tax

Based on your vehicle's CO2 emissions and fuel type, road tax can range from £0 for electric vehicles to over £2,000 for high-emission vehicles.

What this means for your budget: Most modern medium-sized petrol cars fall into the £150-£175 per year range, while diesel vehicles often cost slightly more.

Carlingo tip: All vehicles annual road tax costs can be researched online, helping you factor this into your ownership calculations.

MOT and Servicing

Annual MOT tests are mandatory for vehicles over three years old, and regular servicing is essential to maintain your car's value, reliability, and safety.

What this means for your budget: An MOT costs a maximum of £54.85, while servicing can range from £150 for a basic service to £400+ for a major service on premium vehicles.

Carlingo tip: Read plenty of online reviews from local MOT Centres to help you choose the best garage.

Repairs and Maintenance

As vehicles age, they inevitably require repairs beyond routine servicing.

What this means for your budget: The average UK driver spends around £300-£400 annually on repairs, but this figure increases significantly as cars age beyond 5-7 years.

Carlingo tip: All our vehicles undergo rigorous multi-point inspections before sale, and we can offer extended warranties to protect you against unexpected repair costs.

Parking and Tolls

Regular commuters in urban areas often spend significant amounts on parking fees, residents' permits, and toll roads.

What this means for your budget: If you commute to a city centre and pay for parking, this could easily add up to £1,000-£2,000 per year in expenses that aren't usually factored into car ownership calculations.

Carlingo tip: Consider your regular driving routes and parking needs when choosing a vehicle. Smaller cars are often cheaper to park in tight city spaces with premium parking rates.

Tyres and Consumables

Tyres, wiper blades, bulbs, and other consumables need regular replacement.

What this means for your budget: Expect to spend £300-£600 on a set of four quality tyres every 2-3 years, with premium vehicles often requiring more expensive tyres.

Carlingo tip: Our pre-delivery inspections ensure that all consumables are in excellent condition when you drive away, giving you peace of mind.

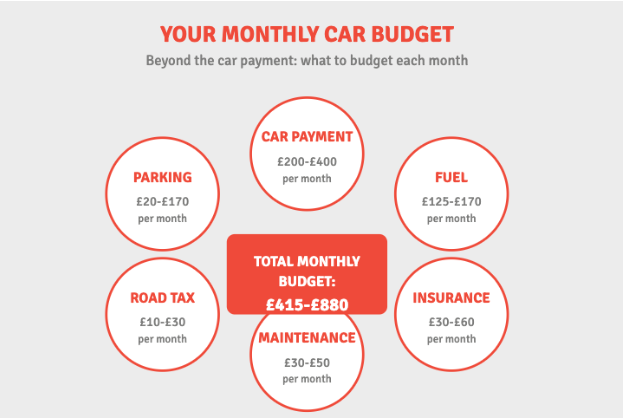

Calculating Your True Monthly Car Budget

To determine what you can truly afford, we recommend this calculation approach:

- Purchase costs: Convert your car payment or depreciation into a monthly figure

- Operating costs: Add monthly equivalents for fuel, insurance, tax, MOT, and servicing

- Contingency fund: Add a monthly amount (we suggest £50-£100) for unexpected repairs

- Usage costs: Estimate monthly parking, tolls, and other usage-based expenses

When you add these together, you'll have a much more realistic picture of your monthly vehicle expenses than just looking at the purchase price or finance payment.

Making Smart Choices with Carlingo

At Carlingo, we want our customers to drive away with not just a great car, but also a sustainable financial plan for car ownership. Our transparent approach to selling quality used cars helps you avoid the steepest depreciation while still enjoying a reliable, attractive vehicle.

We invite you to visit our Harrogate showroom, where our team can help you find a vehicle that fits both your lifestyle needs and your true budget capacity. By understanding the full picture of car ownership costs, you're empowered to make choices that will serve you well for years to come.

Remember, the most expensive car isn't always the one with the highest price tag – it's the one whose total ownership costs stretch your budget beyond comfortable limits. Let Carlingo help you find that perfect balance between desire and financial prudence.