Zero Deposit Car Finance: Is It Right For You? A 2025 Analysis

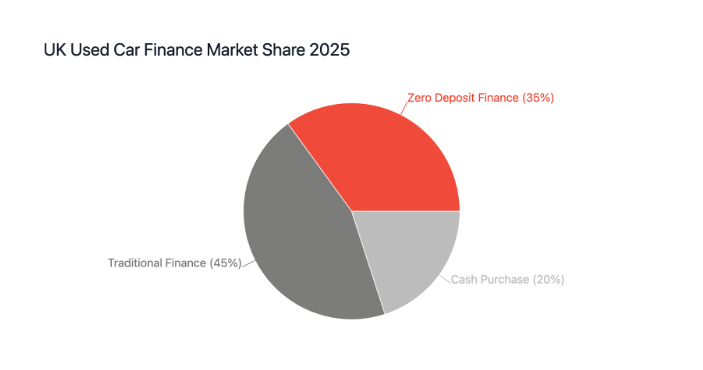

In today's challenging economic climate, zero-deposit car finance has become an increasingly attractive option for UK car buyers. As we navigate through 2025, with interest rates and living costs continuing to impact household budgets, understanding this financing option is crucial for anyone looking to purchase a used vehicle.

At Carlingo, we're committed to helping our customers make informed decisions about their car finance journey.

Understanding Zero Deposit Car Finance

Zero-deposit car finance allows you to secure a vehicle without paying an upfront deposit. Instead of making an initial payment, you spread the entire cost of the car across monthly instalments. This approach has gained significant traction, particularly among first-time buyers and those looking to preserve their savings in uncertain economic times.

Advantages of Zero Deposit Finance

Immediate Vehicle Access

One of the most compelling benefits is the ability to drive away in your chosen vehicle without depleting your savings. This can be particularly valuable when you need a car quickly for work or family commitments.

Financial Flexibility

By keeping your savings intact, you maintain a financial buffer for unexpected expenses. This can be especially important given the current economic climate and rising living costs across the UK.

Competitive Monthly Payments

Many lenders now offer competitive APR rates on zero deposit agreements, making monthly payments more manageable than you might expect. However, it's important to note that rates typically depend on your credit score and financial history.

Important Considerations

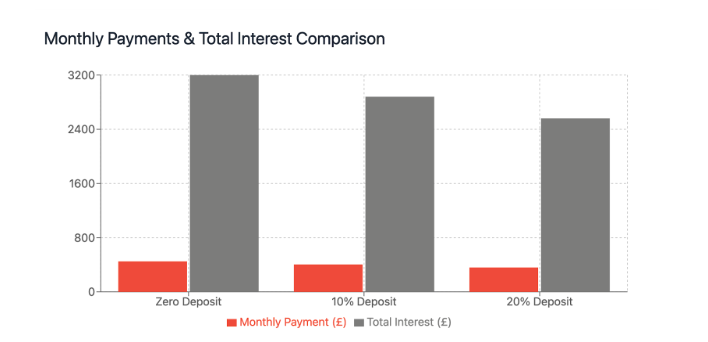

Higher Monthly Payments

Without a deposit to reduce the principal amount, your monthly payments will be higher than with a traditional finance agreement. You'll need to carefully assess whether these increased payments fit comfortably within your monthly budget.

Total Cost Implications

The absence of a deposit means you're financing the entire vehicle cost, which results in paying more interest over the agreement term. We recommend using our online finance calculator to understand the total cost implications fully.

Credit Requirements

Zero deposit options typically require a stronger credit score than traditional finance agreements. Lenders need additional assurance when offering 100% finance, so your credit history will be carefully scrutinised.

Making an Informed Decision

Before proceeding with a zero deposit agreement, consider the following key factors:

Monthly Budget

Calculate your monthly disposable income after essential expenses. Remember to factor in fuel costs, insurance, maintenance, and road tax.

Agreement Length

Consider how long you want to be committed to the finance agreement. Longer terms mean lower monthly payments but higher total interest costs.

Future Plans

Think about your future financial commitments and career plans. Will you be able to maintain the payments if your circumstances change?

Car Finance Options

Low Deposit Finance

If you can afford a small deposit, even 5-10% of the vehicle's value can significantly reduce your monthly payments and total interest costs.

Personal Contract Purchase (PCP)

PCP agreements often require lower monthly payments, though you'll need to decide whether to make the balloon payment at the end of the term.

Hire Purchase (HP)

Traditional HP agreements with a deposit might work out more cost-effectively in the long run, especially if you plan to keep the vehicle long-term.

Why Choose Carlingo for Your Finance Needs?

At Carlingo, we understand that every customer's financial situation is unique. Our dedicated team works with multiple lenders to find the most suitable arrangement for your circumstances.

We offer:

- Transparent advice and guidance throughout the process

- A competitive APR from our panel of trusted lenders

- Flexible terms to suit your budget and lifestyle

- Quick and straightforward application process

- Full Financial Conduct Authority (FCA) compliance

Understanding Credit Scores and Zero Deposit Finance

Your credit score plays a pivotal role in securing zero-deposit car finance in the UK. As of 2025, lenders have become increasingly thorough in their assessment of creditworthiness, particularly for no-deposit agreements.

What Credit Score Do You Need?

While each lender has their own criteria, most UK providers typically look for:

A credit score of at least 650 with Experian or simliar

No recent CCJs (County Court Judgments)

A stable address history

Proof of regular income

Improving Your Credit Score

If your credit score needs improvement before applying, consider these effective steps:

- Register on the electoral roll at your current address

- Ensure all bills are paid on time using direct debit

- Reduce existing credit utilisation to below 30%

- Check your credit report for errors and have them corrected

- Avoid making multiple finance applications in a short period

Regular Credit Monitoring

We recommend monitoring your credit score through services like Experian, Equifax, or TransUnion. Many of these providers offer free monthly credit score updates, helping you track your progress and choose the best time to apply for finance.

Taking the Next Step

If you're considering zero-deposit car finance, we encourage you to speak with our experienced team members. We'll take the time to understand your needs and circumstances, explaining all available options clearly and without pressure.

Visit our latest stock and use our online finance checker to get an initial indication of available rates.

Checking your eligibility won't affect your credit score, and our team is always happy to answer any questions you might have about the process.

Making the right financial decision is crucial, and we're here to help you every step of the way. Whether zero deposit finance is right for you depends on your individual circumstances, but with our guidance, you can make an informed choice that serves your needs both now and in the future.